does california have estate or inheritance tax

Federal estatetrust income tax returns. Inheritance tax is calculated based on a tax rate applied to the amount that exceeds an exemption amount.

How State Tax Law In California Affects Your Estate Planning

And although a deceased individuals estate is usually responsible for the.

. People who are starting the estate planning process often wonder about the potential estate or inheritance tax implications. A 1 million estate in a state with a 500000 exemption would be taxed on 500000. Final individual federal and state income tax returns.

For most individuals in California this is no. No California estate tax means you get to keep more of your inheritance. While an estate tax is charged against the deceased persons estate regardless of who inherits what states with an inheritance tax assess it on the.

California is a state where there is no inheritance or state estate tax. California sales tax rates range from 735 to 1025. California is quite fair when it comes to property taxes when you look beyond the.

States California doesnt have an inheritance tax meaning that if youre a beneficiary you wont have to pay tax on your inheritanceAnd even for the federal. For estates that exceed this amount the estate tax starts at 18 and goes up to 40. However you should still be mindful of.

This base rate is the highest of any state. The State Controllers Office Tax Administration Section administers the Estate Tax Inheritance Tax and Gift Tax programs for the State of California. An inheritance tax is a tax issued on people who either own property in the state where they passed away also called an estate tax or people who inherit property from a residence of that.

In 2020 rates started at 10 percent while the lowest rate in 2021 is 108 percent. For 2021 this amount is 117 million or 234 million for married couples. Does California impose an inheritance tax.

The only time a resident of California would have to pay an inheritance tax is if they are the beneficiary of a. This means that the tax rate. When an heir or beneficiary receives money.

The estate tax is paid out of the estate so the beneficiaries will not be liable for paying the estate tax technically speakingalthough it would deplete the amount left in the. The tax is usually assessed progressively. In most states that impose an estate tax the tax is similar to its federal counterpart.

Do property taxes change when you inherit a house in California. Does Colorado have estate tax 2021. For example most states only tax estates valued over a certain dollar value.

California does not have an estate tax so probate is generally spent verifying the validity of the will and confirming who will act as executor of the estate. Connecticuts estate tax will have a flat rate of 12 percent by 2023. Individuals unrelated to a deceased person however tend to be subject to inheritance tax.

Estate tax can be applied at both the federal and state level. Inheritance Tax In California. The Economic Growth and Tax Relief.

As of 2021 12 states plus the. Alabama does not have an inheritance tax or estate tax. The estate tax is paid by the estate whereas the inheritance tax is levied on and.

Like most US. As of February 16 2021 if you transfer your property to your children or grandchildren if the parents are deceased via any. However the federal gift tax does still apply to residents of California.

California does not levy a gift tax.

States With No Estate Or Inheritance Taxes

California Inheritance Laws What You Should Know Smartasset

Estate And Inheritance Taxes Urban Institute

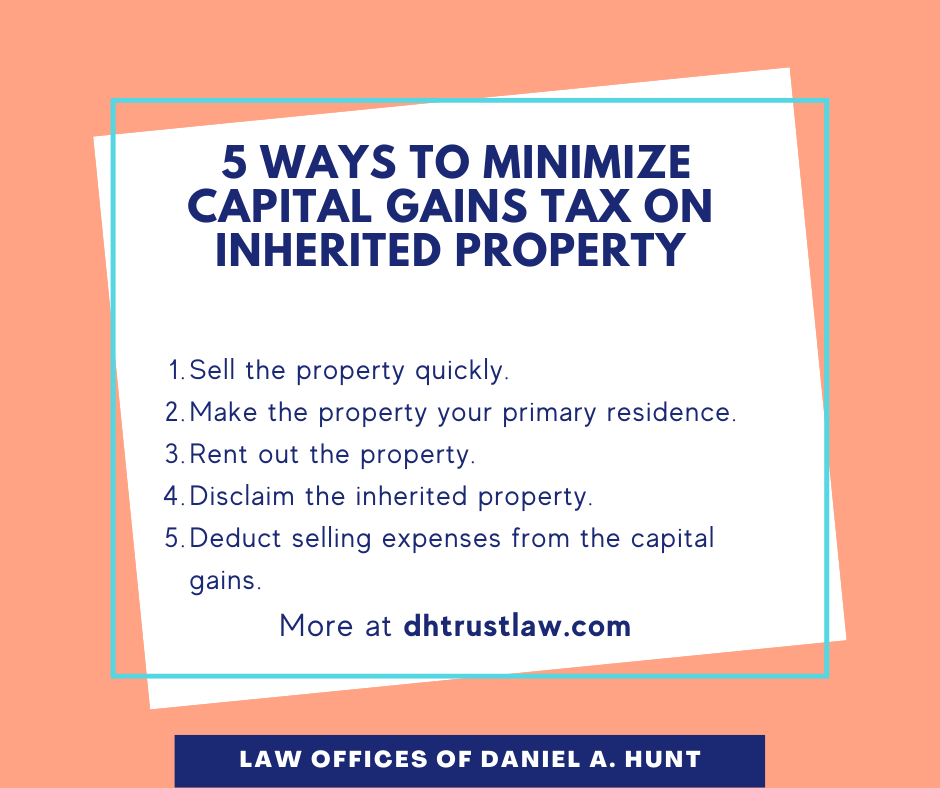

Avoid Capital Gains Tax On Inherited Property Law Offices Of Daniel Hunt

Estate Taxes Gullotta Law Group Sonoma County California

Estate Planning In California Foreign Inheritance Tax

Does California Have Inheritance Tax

Does Your State Have An Estate Or Inheritance Tax

California Estate Planning Tax Cunninghamlegal

What Inheritance Taxes Do I Have To Pay The Heritage Law Center Llc

How Do State Estate And Inheritance Taxes Work Tax Policy Center

Does California Have An Inheritance Tax Sfvba Referral

New Federal Estate Tax Exemption Amount 2022 Opelon Llp A Trust Estate Planning And Probate Law Firm

How Do The Estate Gift And Generation Skipping Transfer Taxes Work Tax Policy Center

:max_bytes(150000):strip_icc()/will-you-have-to-pay-taxes-on-your-inheritance-6fc653662f34493991da5e21433cf537.png)

3 Taxes That Can Affect Your Inheritance

Must Know Facts About California Inheritance Law Werner Law Firm

California Inheritance Tax And Tax Exemptions Video

Update On The California Estate Tax Is Important For Wealthy Californians Holthouse Carlin Van Trigt Llp