michigan gas tax revenue

Michigan per capita excise tax. We can shift out the sales tax at the pump and replace it with a revenue-neutral gas tax Chatfield told reporters Thursday.

What Does An Additional Penny Of Gas Tax Buy Bridge Michigan

City Individual Income Tax Notice IIT Return Treatment of Unemployment Compensation City Business and Fiduciary Taxes.

. 52 rows The current federal motor fuel tax rates are. The Michigan Severance Tax Act MCL 205301 levies a tax on oil and gas severed from the soil in Michigan. Michigan severance tax returns must be filed monthly by the 25th of the month following the production.

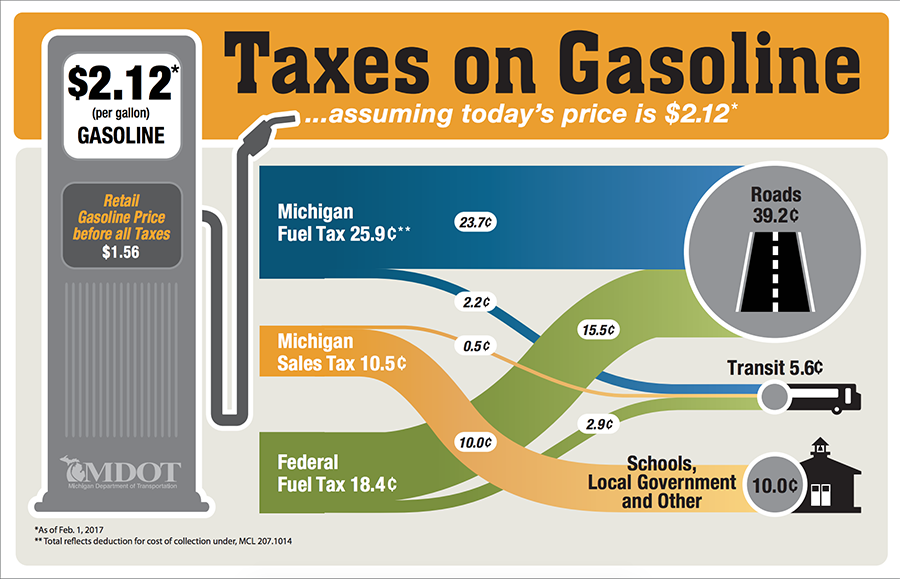

The fuel was used on a farm for farming purposes in carrying on a trade or. The revenue Michigan received from its motor fuel tax MFT in fiscal year 2018 was 226 billion of which 259 percent or 5879 million was diverted to the states School Aid Fund. 1 2017 as a result of the 2015 legislation.

Getting gas can be pricy depending on the vehicle and oil market but in Michigan drivers could be forced to shell out more at the station if a. 0183 per gallon. 120 cents per Michigan sales tax 6 of 200 TOTAL 567 cents.

Approximately 44 billion taxable gallons of gasoline were consumed in Michigan in 2011. 263 cents per Michigan motor fuel tax. The revenue Michigan received from its motor fuel tax in fiscal year 2018 was 226 billion of which 259 or 5879 million was diverted to.

Michigan fuel taxes last increased on Jan. Didnt gas taxes just go up. Call center services are available from 800am to 445PM Monday Friday.

New York diverts 375 of its gas tax revenue Rhode Island diverts 371 New Jersey and Michigan divert 339 Maryland diverts 325 Connecticut diverts 27 Texas diverts 24 Massachusetts diverts 239 Florida. Liquefied Natural Gas LNG 0243 per gallon. Motor Fuel Tax Mi.

Federal excise tax rates on various motor fuel products are as follows. Finally the package earmarked specified annual amounts of. Gas Tax rate can vary from 283-363 cpg depending on area Other Taxes include 2071 USTInspection fee diesel 125 cpg state sales tax 2196 USTInspection fee gasoline The state excise tax is 75 cpg on gas and diesel additional 138 ppg state sales tax on diesel 118 ppg state sales tax on gasoline.

Effective january 1 2012 the mbt was replaced with a 6 corporate income tax. Diversions can leave roads and highways underfunded. Another 74 percent or 1676 million was diverted to the states Comprehensive Transportation Fund.

The 10 states diverting the largest percentage of their gas tax money. 0263 represented the Michigan gasoline tax 0184 represented the Federal gasoline tax and 0141 represented the Michigan sales tax. That is a responsible first step in ensuring that our roads are properly funded Whitmer proposes a 45-cent-per-gallon gas tax increase phased in over a year that would raise about 25 billion for roads.

0219 gallon Most jet fuel that is used in commercial transportation is 044gallon. FEDERAL AND STATE FUEL EXCISE TAX EXEMPTIONS. Figure 3 Crude Oil 146 Refining 034 DistributionMarketing 035 Federal Motor Fuel Tax 018 Mi.

Fund 026 Michigan Sales Tax 014 School Aid Fund 0103 Const. Revenue from Michigans General Fund and School Aid Fund earmarked taxes totaled 26 billion in March 2022 up 733 from the March 2021 level. Includes revenue from the single business tax sbt michigan business tax mbt corporate income tax cit and insurance company premiums taxes revenues.

In addition to state gas taxes which can make up between 5 percent and more than 20 percent of the cost of gas the federal government levies a. The Michigan Senate this week gave final approval to a bill that would suspend the states 272-cents-per-gallon gas tax for six months but the Republican majority did not have enough votes to give the bill immediate effect meaning it would not cut prices until 2023. On top of other costs Michigan currently imposes a 19-cent per gallon excise tax on gasoline last updated in 1997 and a 15-cent per gallon excise tax on.

The 25 billion plan would increase the 26-cent fuel tax by 45 cents between this October and October 2020 and guarantee that the additional revenue is targeted to. If a gallon of gas at the pump sells for 256 cents then 22 of the price is composed of federal and state taxes. In Michigan the revenue from regular gasoline sales tax was projected to be 621 million in the 2022 fiscal year.

At this level of consumption and an average pump price of 350 per gallon the sales tax on gasoline sales would have generated approximately 8183 million in. The federal gasoline tax 184 cents per gallon the michigan. She has advocated for ending some taxes on pensions and expanding the Earned Income Tax Credit a tax break for low-income families.

Michigan General Excise Taxes - Gasoline Cigarettes and More Michigan collects general excise taxes on the sale of motor fuel gasoline and diesel cigarettes per pack and cell phone service plans. And the states gas tax as a share of the total cost of a gallon of gas stood at 177 percent. COVID-19 Updates for Michigan Motor Fuel Tax Motor Fuel Tax Return filing deadlines have not changed.

Michigan collects an average of 379 in yearly excise taxes per capita lower then 70 of the other 50 states. Producers or purchasers are required to report the oil and gas production and the value in a monthly return. But that was based on.

Gov Whitmer Vetoes Legislation To Suspend Michigan S 27 Cent Gas Tax Mlive Com

Michigan S Gas Tax How Much Is On A Gallon Of Gas

Michigan Gas Utilities Charitable Giving Wec

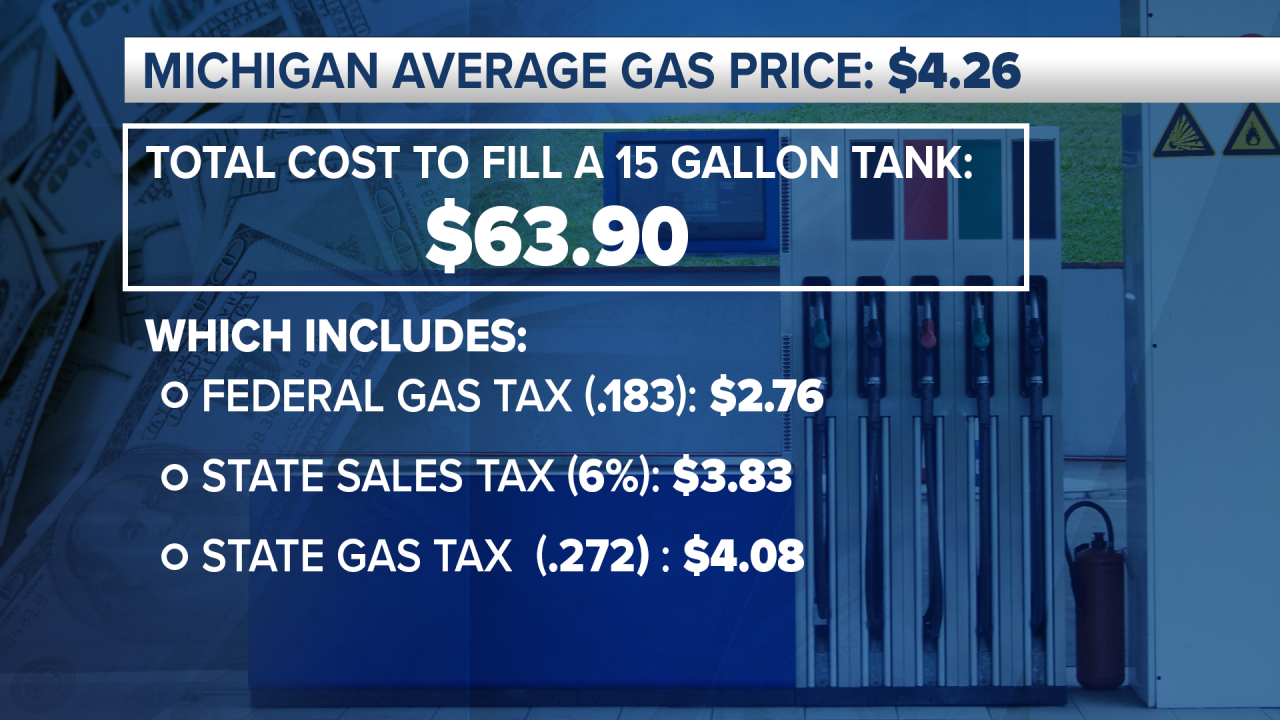

Lawmakers Want To Suspend The Gas Tax Here S How Much Michiganders Are Taxed At The Pump

Lawmakers Eye Pause In Michigan Gas Tax As Prices Soar But Which Tax Bridge Michigan

Financial Information Ottawa County Road Commission

Lawmakers Want To Suspend The Gas Tax Here S How Much Michiganders Are Taxed At The Pump

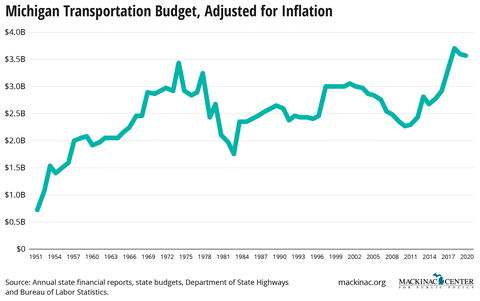

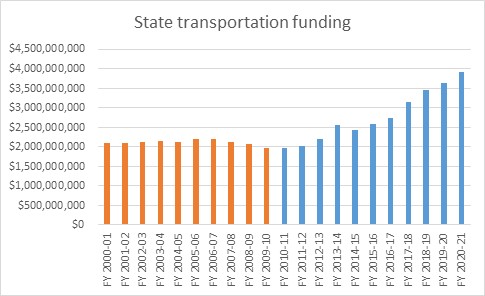

Less Road Funding From The Road Fixing Governor Mackinac Center

Gas Tax By State 2022 Current State Diesel Motor Fuel Tax Rates

Michigan Gas Tax Going Up January 1 2022

How Road Funding Works In Michigan Roads In Michigan Quality Funding And Recommendations Mackinac Center

Gas Tax Vs Sales Tax On Gas Will Michigan Lawmakers Suspend Taxes For Relief At Pump Mlive Com

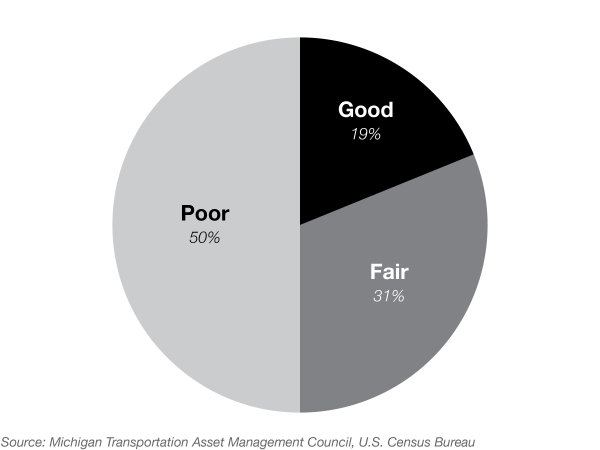

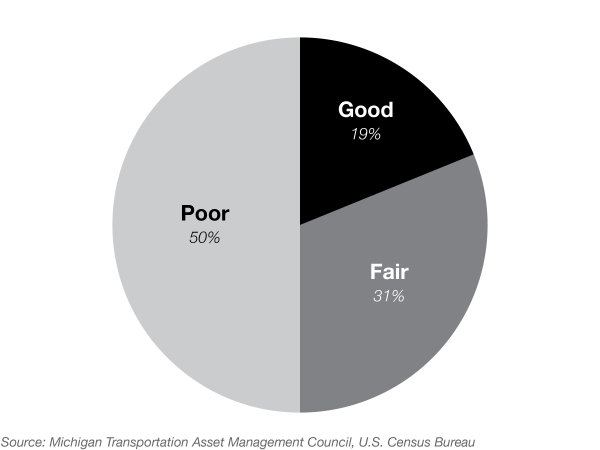

The Real State Of Michigan Roads Poor And Getting Worse Without More Cash Bridge Michigan

Michigan Sales Tax Where Does The Revenue Go And What Could An Increase Mean For Road Funding Mlive Com

Michigan Breaks Records For Highest Gasoline And Diesel Fuel Prices State Abc12 Com

Michigan Road Funding Doubled In 10 Years Michigan Capitol Confidential

Lawmakers Want To Suspend The Gas Tax Here S How Much Michiganders Are Taxed At The Pump

Legal Experts Say Robinhood Is Not Legally Bound To Carry Out Every Trade And Is Protected From Class Action Lawsuits Securities And Exchange Commission Legal